The U.S. dollar is like the English language, pardon my French

Chief Economist Eugenio J. Alemán discusses current economic conditions.

Watching coverage of the BRICS (Brazil, Russia, India, China and South Africa) summit in South Africa this week made us wonder why the members of the BRICS decided to name the section, in which Vladimir Putin was addressing the conference by video conference, “BRICS BUSINESS FORUM,” in English, yes? Of course, the French would have argued to use French as the official language of the conference because they still believe that French is the ”universal language” of the world. Of course, they may even want everybody to use the French franc as the ”universal currency” of the world. Wait, but not even the French use the French Franc. The currency of choice is determined by what the global economy wants, not what its leaders say they want. It is what their constituents do that matters.

Of course, skeptics would tell us that English is an official language of South Africa, the host country. However, they could have used their other official languages, Afrikaans, Zulu, Venda, Southern Sotho, Swati, Tswana, Northern Sotho, South African Sign, Xhosa, Tsonga, or Ndebele. But no, they chose English. If you are even more skeptical, you would say: “Well, they chose English because English is also an official language of India.” However, they could have used Hindi because that is also an official language of India. But no, they used English. Granted, they probably used English because if you were to make a ”Venn Diagram” between the official languages spoken in these countries, you will see that the only common language that produces an intersection, i.e., something in common between these countries, is between South Africa and India. That is, they both have English as their official language.

But the truth is that they probably chose English because, despite what my French friends would have wanted, English is the ‘current’ universal language. And yes, this may change in the future and, perhaps we will all be speaking Mandarin or Cantonese, but the future is still not here; so, they all use the current universal language, English. Coincidently, the U.S. dollar is the ‘current’ universal currency. Not because the U.S. government says so. In fact, as we indicated in our Weekly Economics Thoughts of the Week for April 5, 2023) and in our white paper on the Central Bank Digital Currency on July 20, 2023, the U.S. dollar is “legal tender for all debts, public and private” in the U.S. and its territories, not in the rest of the world. The fact that it is also a trusted currency and accepted in the rest of the world is a testament to the trust behind the policies followed by U.S. institutions that protect the value of the U.S. dollar, period. This trust is second to none. And until this changes, the U.S. dollar will remain the most trusted currency in the world.

Backing a BRICS currency with gold? No way Jose

Only those who are trying to sell gold at any cost (i.e., at any price!) would argue that the BRICS countries could be contemplating backing a presumed BRICS currency with gold. The math is very simple (even though we are not going to use math for our explanation), if the BRICS countries try to back their presumed currency with gold, they have to stand ready to sell all the gold they possess at whatever exchange rate, or price, they set their currency to be against gold. This means that they give up their ability to conduct monetary and even fiscal policy if, as they normally do, they monetize their fiscal deficits. That is, this is something that the Chinese government, the Brazilian government, the Russian government, the Indian government, and the South African government typically do so there is probably no chance that they will engage in this process.

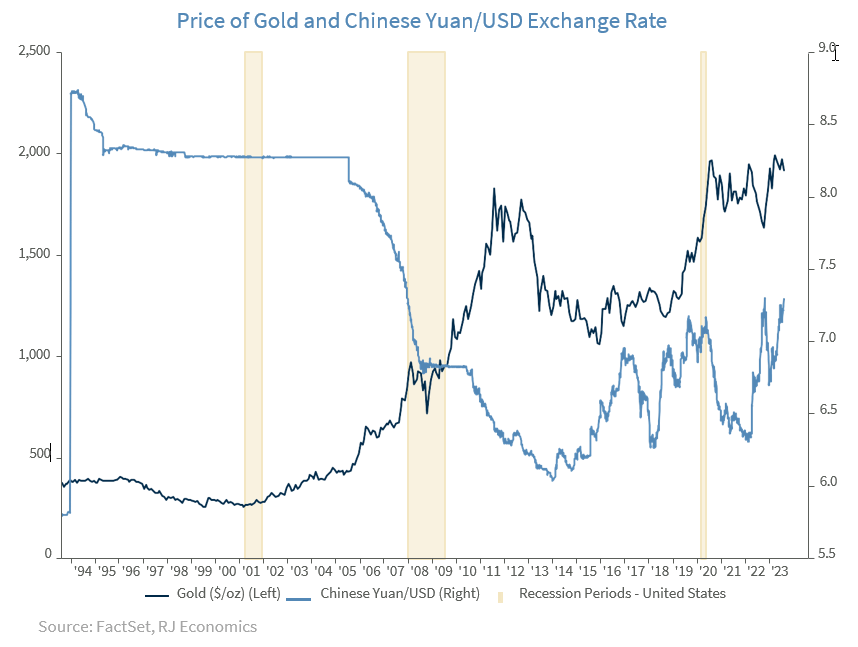

Do we really believe that the Chinese, or the Russians, who are some of the most interested in controlling what they do with their economies, will be ok if markets determined the value of their currency? Of course, the Chinese could, theoretically argue that they will buy lots and lots of gold in order to intervene in the market for gold, i.e., buy or sell gold, to keep the value of their BRICS currency stable.

They could, potentially, even create an international cartel of gold, à la the OPEC cartel, to try to determine the price of gold in the international market. However, this may be easier said than done and highly unlikely.

The issue is that, for any country or group of countries, if they back their currency with any asset, that country has to stand ready to redeem, i.e., exchange that asset, for the currency in question at the pre- established price. If that is the case, these countries allow their fiscal and monetary policy freedom to be determined by the asset in question. According to many, it is the Chinese, who have been buying lots of gold lately, that are pushing for this currency backed by gold. We doubt that this is true, but would have to wait to pass our judgment. However, are you going to try to convince us that a country that still has a closed capital account because they are afraid of the whims of the market economy, a housing market that is in complete disarray, a population in decline, and total debt levels calculated by Bloomberg at more than 285% of GDP, is going to transfer its sovereignty to the whims of the world price of gold? It surely makes no sense.

Changes to our economic forecast

We have made changes to our economic forecast. Our current estimate is that the U.S. economy would experience a very mild recession during the last quarter of 2023 that would last until the first quarter of 2024. However, economic data has been much stronger than what we estimated so far and thus we have decided to move our very mild recession call to the first and second quarters of 2024. Please take a look at our forecast table at the end of this publication to see our new forecast for the U.S. economy.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those of Raymond James and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur. Last performance may not be indicative of future results.

Consumer Price Index is a measure of inflation compiled by the US Bureau of Labor Statistics. Currencies investing is generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

Consumer Sentiment is a consumer confidence index published monthly by the University of Michigan. The index is normalized to have a value of 100 in the first quarter of 1966. Each month at least 500 telephone interviews are conducted of a contiguous United States sample.

Personal Consumption Expenditures Price Index (PCE): The PCE is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The change in the PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.

The Consumer Confidence Index (CCI) is a survey, administered by The Conference Board, that measures how optimistic or pessimistic consumers are regarding their expected financial situation. A value above 100 signals a boost in the consumers’ confidence towards the future economic situation, as a consequence of which they are less prone to save, and more inclined to consume. The opposite applies to values under 100.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.

GDP Price Index: A measure of inflation in the prices of goods and services produced in the United States. The gross domestic product price index includes the prices of U.S. goods and services exported to other countries. The prices that Americans pay for imports aren't part of this index.

The Conference Board Leading Economic Index: Intended to forecast future economic activity, it is calculated from the values of ten key variables.

The Conference Board Coincident Economic Index: An index published by the Conference Board that provides a broad-based measurement of current economic conditions.

The Conference Board lagging Economic Index: an index published monthly by the Conference Board, used to confirm and assess the direction of the economy's movements over recent months.

The U.S. Dollar Index is an index of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies. The Index goes up when the U.S. dollar gains "strength" when compared to other currencies.

The FHFA House Price Index (FHFA HPI®) is a comprehensive collection of public, freely available house price indexes that measure changes in single-family home values based on data from all 50 states and over 400 American cities that extend back to the mid-1970s.

Import Price Index: The import price index measure price changes in goods or services purchased from abroad by U.S. residents (imports) and sold to foreign buyers (exports). The indexes are updated once a month by the Bureau of Labor Statistics (BLS) International Price Program (IPP).

ISM New Orders Index: ISM New Order Index shows the number of new orders from customers of manufacturing firms reported by survey respondents compared to the previous month. ISM Employment Index: The ISM Manufacturing Employment Index is a component of the Manufacturing Purchasing Managers Index and reflects employment changes from industrial companies.

ISM Inventories Index: The ISM manufacturing index is a composite index that gives equal weighting to new orders, production, employment, supplier deliveries, and inventories.

ISM Production Index: The ISM manufacturing index or PMI measures the change in production levels across the U.S. economy from month to month.

ISM Services PMI Index: The Institute of Supply Management (ISM) Non-Manufacturing Purchasing Managers' Index (PMI) (also known as the ISM Services PMI) report on Business, a composite index is calculated as an indicator of the overall economic condition for the non-manufacturing sector.

Consumer Price Index (CPI) A consumer price index is a price index, the price of a weighted average market basket of consumer goods and services purchased by households. Changes in measured CPI track changes in prices over time.

Producer Price Index: A producer price index (PPI) is a price index that measures the average changes in prices received by domestic producers for their output.

Industrial production: Industrial production is a measure of output of the industrial sector of the economy. The industrial sector includes manufacturing, mining, and utilities. Although these sectors contribute only a small portion of gross domestic product, they are highly sensitive to interest rates and consumer demand.

The NAHB/Wells Fargo Housing Opportunity Index (HOI) for a given area is defined as the share of homes sold in that area that would have been affordable to a family earning the local median income, based on standard mortgage underwriting criteria.

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index measures the change in the value of the U.S. residential housing market by tracking the purchase prices of single-family homes.

The S&P CoreLogic Case-Shiller 20-City Composite Home Price NSA Index seeks to measures the value of residential real estate in 20 major U.S. metropolitan.

Source: FactSet, data as of 7/7/2023